OFFERING

Description:

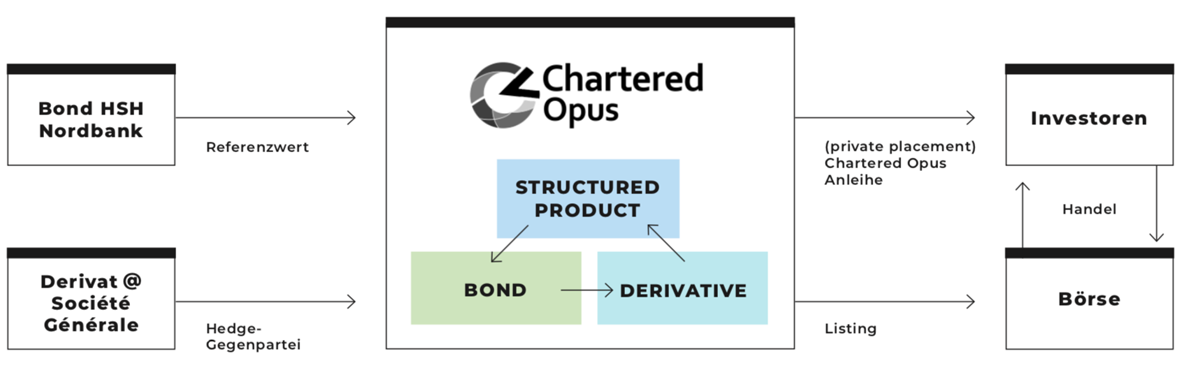

- Structured products combine a funding component (reference bond) with a derivative component (optionality)

- The reference bond exposes the investor to the credit risk and the funding rate of the obligor of the reference bond (the higher the credit risk the higher the funding rate and vise versa)

- The funding rate received from the reference bond is transformed into highly tailored optionality

Why Chartered Opus:

- Dedicated issuance program for public offerings in EU countries on all major payoffs

- Highly customizable payoffs for private placements

- ISDA agreements with multiple hedge counterparties in place (optionality)

- Large universe of reference bonds (incl. intruments which would be balance sheet expensive for traditional bank issuers) open a wide range of new credit and market opportunities

- Structured products issued by Chartered Opus are bankruptcy-remote and do not suffer from additional issuer credit risk (as in the case with bank issuers)

Example: CMS Spread Range Accrual with Reference Value HSH Nordbank

Investors have the opportunity to integrate a specific risk-return profile into their portfolio via a structured bond. In contrast to a traditional bank issue, the investor in a Chartered Opus bond also has a free choice of funding and can therefore also freely scale the issuer risk. Consequently, the structure offers the investor the possibility to take exactly the risk position he prefers. There is no risk addition as with conventional certificates issued by banks.