Making

alternatives

investible

The Issuance Platform for

Structured Products

We offer the full-service spectrum from origination, structuring, issuance to life cycle management of investment products. In addition, we facilitate bespoke white-labelling setup or specialised issuance programmes for our clients.

How it Works

Opus is a bank-independent issuance platform offering professional market participants the opportunity to create highly tailored investment products. Since 2013, OPUS has realised more than 1,000 securitisations and is a leader in making alternatives investible.

Your benefits

TAILOR-MADE INVESTMENT PRODUCTS

We support our clients in designing and launching highly tailored investment products by providing our structuring know-how and multiple ready-to-go issuers.

ONE-STOP SOLUTION

We provide all securitisation services needed and under a transparent fee setup.

AUTOMATION

We unite automation of the issuance process and product life cycle management with a high degree of product governance.

NETWORK

We provide a network of brokers, hedge counterparties, lawyers, custodians, paying agents, data and valuation services providers to find the most efficient solution for our clients.

ECONOMIES OF SCALE

Leveraging our long-term relationships with service providers, continuous investments in our infrastructure and know-how built over the years ensures the cost efficiency of our issuance platform.

SECURITY

We issue from a regulatory strong, safe, and tested jurisdiction - assets on our issuers’ balance sheets are segregated and ring-fenced.

INNOVATION

We are not only the first multi-issuer platform in Luxembourg, but we also launched the first structured product on the blockchain worldwide.

TRANSACTION EXPERIENCE

Executing more than 1,000 securitisations means our team has covered almost any product structure and asset risk.

Facts & figures

2013

Founding year

#1

Issuer in the Luxembourg securitization market by market share

5bn+

USD securitized assets

1‘000+

Completed transactions and index solutions

500+

Active Luxembourg compartments

100+

B2B clients served

Currencies

EUR

CHF

USD

JPY

GBP

Exchanges

Dusseldorf

Frankfurt

Luxembourg

Zurich

(COMING SOON)

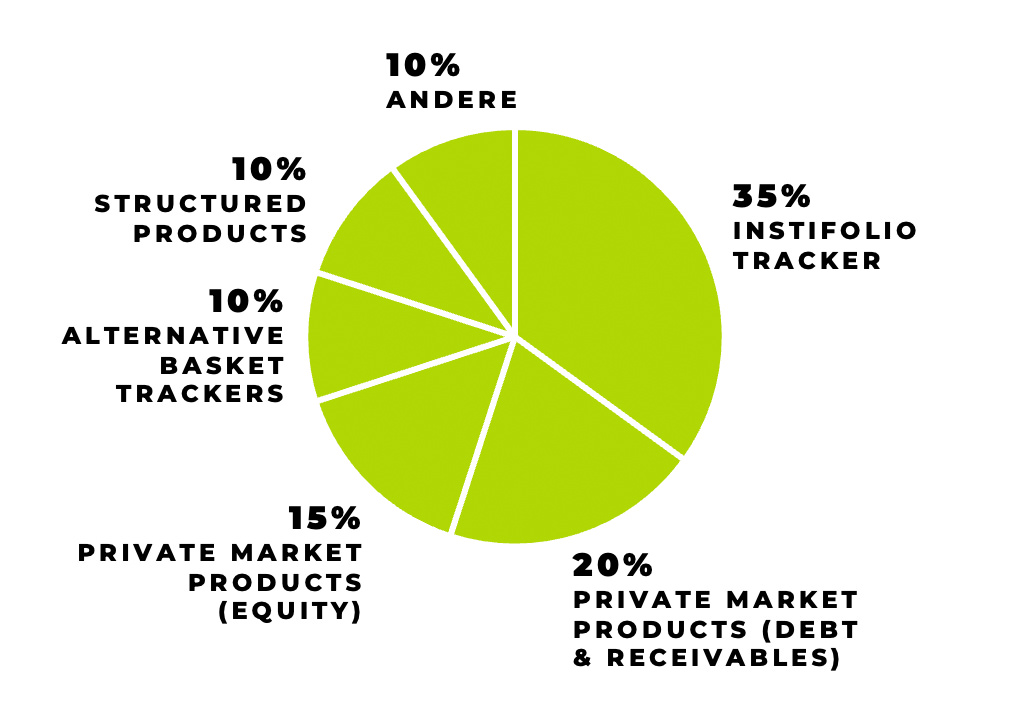

PRODUCT TYPES

PLACEMENTS